Be in charge of how you mature your retirement portfolio by utilizing your specialized know-how and pursuits to speculate in assets that in good shape with all your values. Got know-how in property or personal equity? Utilize it to aid your retirement planning.

IRAs held at banking institutions and brokerage firms provide constrained investment possibilities to their clientele as they would not have the know-how or infrastructure to administer alternative assets.

Have the freedom to speculate in Practically any sort of asset by using a danger profile that matches your investment technique; together with assets that have the possible for the next fee of return.

No, you cannot invest in your own personal organization using a self-directed IRA. The IRS prohibits any transactions among your IRA as well as your personal business as you, since the owner, are thought of a disqualified man or woman.

Opening an SDIRA can give you usage of investments Generally unavailable via a financial institution or brokerage organization. Here’s how to start:

Criminals at times prey on SDIRA holders; encouraging them to open up accounts for the purpose of building fraudulent investments. They typically idiot traders by telling them that If your investment is recognized by a self-directed IRA custodian, it has to be legit, which isn’t legitimate. Once more, make sure to do complete research on all investments you choose.

The primary SDIRA rules in the IRS that traders have to have to know are investment limits, disqualified persons, and prohibited transactions. Account holders will have to abide by SDIRA policies and regulations so as to protect the tax-advantaged status in their account.

Shopper Assist: Try to look for a provider that provides devoted assist, check this site out which include usage of knowledgeable specialists who will answer questions on compliance and IRS policies.

This features being familiar with IRS polices, managing investments, and staying away from prohibited transactions that might disqualify your IRA. A lack of data could bring about high-priced faults.

Subsequently, they have a tendency not to promote self-directed IRAs, which provide the flexibility to invest inside of a broader variety of assets.

And because some SDIRAs like self-directed conventional IRAs are subject to necessary minimum amount distributions (RMDs), you’ll need to prepare ahead to ensure that you might have more than enough liquidity to fulfill The principles set through the Homepage IRS.

Entrust can support you in getting alternative investments along with your retirement resources, and administer the acquiring and promoting of assets that are generally unavailable by means of banking companies and brokerage firms.

However there are various Positive aspects linked to an SDIRA, it’s not with no its very own negatives. Many of the frequent reasons why traders don’t choose SDIRAs include things like:

Irrespective of whether you’re a economic advisor, investment issuer, or other financial Specialist, explore how SDIRAs may become a robust asset to grow your organization and attain your Qualified goals.

Building quite possibly the most of tax-advantaged accounts means that you can hold much more of The cash which you invest and gain. According to whether or not you decide on a traditional self-directed IRA or possibly a self-directed Roth IRA, you have the probable for tax-free of charge or tax-deferred growth, offered selected circumstances are satisfied.

Many buyers are stunned to discover that working with retirement cash to take a position in alternative assets has become attainable considering that 1974. Nonetheless, most brokerage firms and banking institutions focus on featuring publicly traded securities, like stocks and bonds, as they deficiency the infrastructure and abilities to manage privately held assets, which include real-estate or non-public equity.

Real estate is among the preferred selections amongst SDIRA holders. That’s because you could spend money on any sort of real estate which has a self-directed IRA.

Constrained Liquidity: A lot of the alternative assets which can be held within an SDIRA, for example real-estate, personal fairness, or precious metals, might not be quickly liquidated. This may be a problem read if you might want to access money rapidly.

Incorporating cash straight to your account. Take into account that contributions are topic to yearly IRA contribution boundaries established via the IRS.

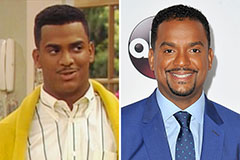

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Shane West Then & Now!

Shane West Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!